A Green Belt and Road

Back to The Belt and Road Initiative31 Oct 2019

Mukhtar Hussein

Produced by (E) BrandConnect

The first phase of the BRI has prompted concern about environmental risks, both from specific projects to their surroundings and, more broadly, from increasing industrial activity and therefore emissions. Attention is warranted: if the BRI does not support the sustainability agenda, the world will not achieve its climate targets. But evidence also shows that China is, in fact, a global environmental leader, suggesting that the BRI could support rather than undermine the sustainability agenda.

China has, for instance, curbed emissions growth in recent years while becoming a global leader in green investment and innovation. It is also the world’s biggest investor in renewable energy, committing more than US$100bn in 2018.1 While many countries are not on track to achieve the environment and climate goals committed to at the Paris climate conference in 2015, China is raising the bar for itself. It has already passed its 2020 target of 105 GW of cumulative installed photovoltaic power.2

China has every reason to care about the environmental crisis. Air pollution costs the country an estimated US$38bn annually.3 It also knows that every aspect of its commercial future, from mobility to digital industry, depends on efficient and sustainable energy. The BRI must not only be low-impact from an environmental perspective; it should also foster investment in the green economy.

Sustainable investment

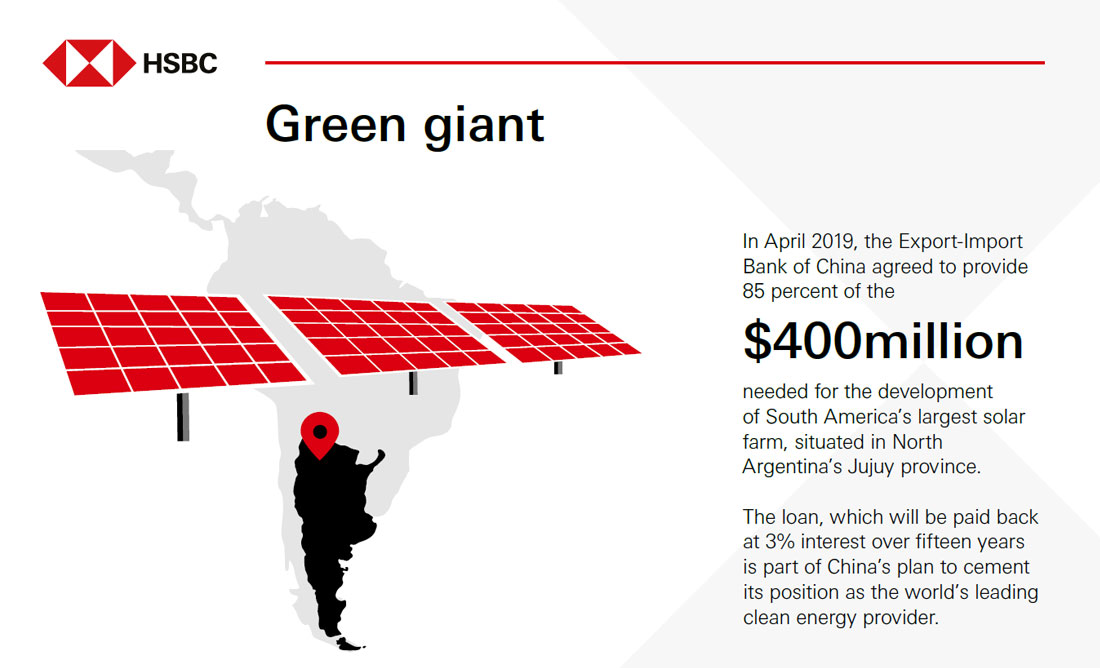

“No country has put itself in a better position to become the world’s renewable energy superpower than China,” stated a report released by the Global Commission on the Geopolitics of Energy Transformation in January 20194. Three months later, the Export-Import Bank of China agreed to provide nearly 85% of the $400-million needed for the development of South America’s largest solar farm.5 The deal, which was agreed on the condition that a majority of the materials needed were purchased from Chinese suppliers, is the latest demonstration of China’s intent to use green energy as a means of economic diversification. This trend will accelerate as the country pushes to meet its revised target of 35% reliance on green energy by 2030.6

But infrastructure projects pose environmental risks that should not be downplayed, such as air and water pollution, soil erosion and habitat destruction, and large-scale hydropower is one of the most challenging assets to build in terms of ecological impact. Transport infrastructure, another major part of the BRI portfolio, poses indirect risks as it opens up new areas for settlement and industrial activity, potentially leading to deforestation or unsustainable practices.7

World-class green standards must be applied to each and every project – and China has shown clear signs that it intends the BRI to promote rather than inhibit sustainability. The Green Investment Principles for Belt and Road, developed by the City of London Corporation’s Green Finance Initiative and China’s Green Finance Committee, have now been supported by 28 financial institutions, including HSBC.8

Those guidelines include commitments to embed sustainability into corporate strategy and culture, to place oversight of risks and opportunities at board and senior management level, and to set up robust systems for monitoring operations and environmental performance in BRI regions. They also commit signatories to environmental disclosure, green supply-chain management, and the utilisation of green financial instruments such as green bonds, green asset-backed securities, emission rights-based financing and green investment funds.

The goal here is not just to improve the environmental governance of projects but to use the BRI as a vehicle to promote green investment and synchronise national efforts to build a low-carbon global economy. Practitioners across the BRI will need to be aware that long-term economic success will only be achieved through sustainable means. Guided by solid environmental principles, the BRI represents an opportunity to have a lasting impact on infrastructure development around the globe.

Produced by (E) BrandConnect, a commercial division of The Economist Group, which operates separately from the editorial staffs of The Economist and The Economist Intelligence Unit. Neither (E) BrandConnect nor its affiliates accept any responsibility or liability for reliance by any party on this content.

Related articles

The Belt and Road Initiative

In this four-article series, we examine how the BRI is evolving in response to the lessons and challenges so far, and what this could mean for the global economy, from climate change to regional economic development and from project governance to trade connectivity. Our first article explores the theme of participation and governance.

Connecting the world

Our second article explores how the BRI is moving from infrastructure projects to a broader focus on increased cross-border and international connectivity.

HSBC and the BRI

Our final article explores how HSBC's own deep roots in Asia position us to support regional and global clients seeking to join the BRI's new phase

China has every reason to care about the environmental crisis. Air pollution costs the country an estimated US$38bn annually. It also knows that every aspect of its commercial future, from mobility to digital industry, depends on efficient and sustainable energy. The BRI must not only be low-impact from an environmental perspective; it should also foster investment in the green economy.

1 https://about.bnef.com/blog/clean-energy-investment-exceeded-300-billion-2018/

2 https://www.pv-magazine.com/2018/11/05/china-may-raise-2020-solar-target-to-over-200-gw/

3 https://www.scmp.com/news/china/science/article/2166542/air-pollution-killing-1-million-people-and-costing-chinese

4 http://geopoliticsofrenewables.org/report

5 https://uk.reuters.com/article/uk-argentina-china-solar-insight/on-south-americas-largest-solar-farm-chinese-power-radiates-idUKKCN1RZ0B6

6 https://www.scmp.com/news/china/politics/article/2165831/china-steps-green-energy-push-revised-renewable-target-35-2030

7 https://blogs.worldbank.org/trade/green-belt-and-road-feasible-how-mitigate-environmental-risk-bri-infrastructure-project

8 https://news.cityoflondon.gov.uk/green-belt-and-road-principles-receive-industry-backing/

Produced by

(E) BrandConnect

Contact us

HSBCnet Service Hotline

400 821 8878

Hotline for Commercial Banking Customer. Customer from Global Banking please contact your Customer Service Manager directly.

HSBC China Business Official WeChat Accounts

HSBC China Business WeChat Subscription Account

A thought leadership content hub that shares market trends, expert insights, industry reports, and global sponsorship news.

HSBC China Business WeChat Service Account

Scan QR code to follow.

HSBCnet Mobile App

iPhone

Android